Financial Crimes Agency FinCEN Scraps ID Docs Rule for Casino Patrons

Posted on: October 21, 2021, 10:20h.

Last updated on: October 21, 2021, 10:50h.

The US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) has relaxed regulations surrounding the ID verification of casino customers. The agency said Wednesday casinos would now be permitted to use “non-documentary means” to ID their patrons.

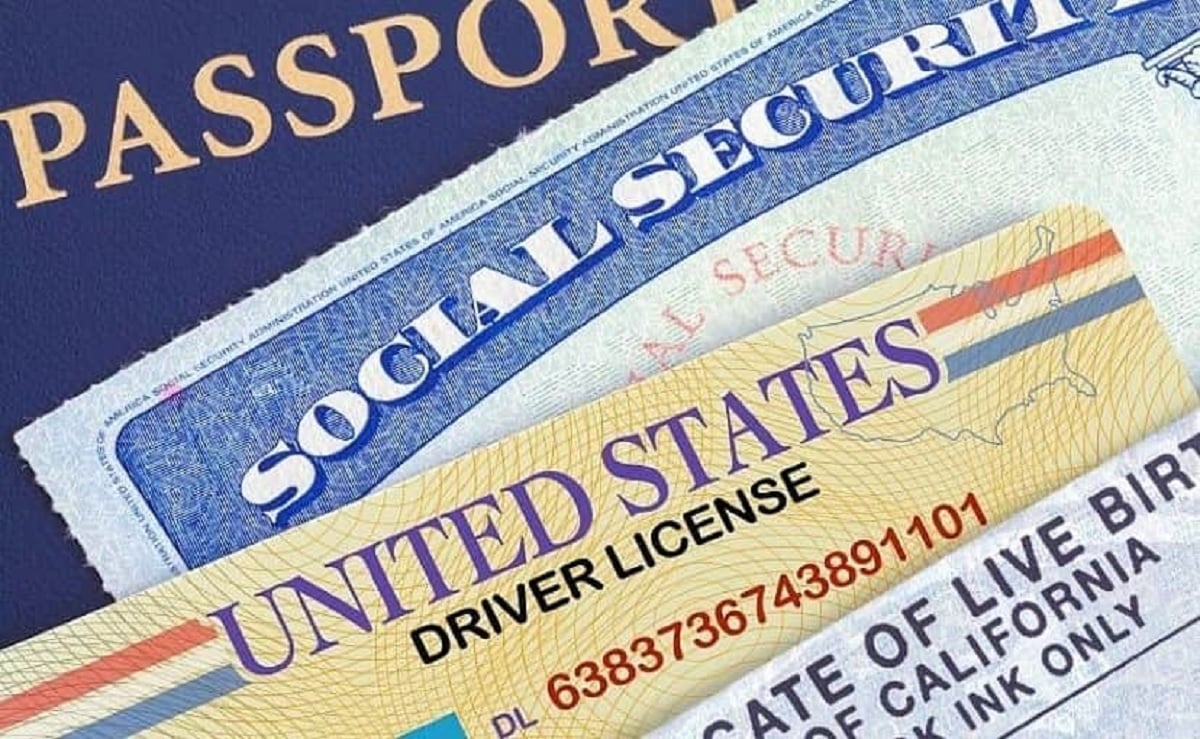

Previously, staff were required to inspect identity documents, such as a driver’s license or passport, before they could accept customer’s funds, open an account for them, or extend credit.

Now they can do this using a variety of methods, including checking details against a third-party consumer reporting agency, public database, or via other financial institutions. According to FinCEN, staff can simply communicate with customers and test their responses against known data points, a system sometimes called “knowledge-based authentication.”

The new regulations reflect the reality of gaming in the US, where many Americans now gamble online through websites that use this kind of technology to verify their identities.

‘Industry Has Evolved’

FinCEN is tasked with collecting and analyzing information about financial transactions in the fight against money laundering, terrorist financing, and other financial crimes.

The casino industry has become accustomed to a gradual tightening of anti-money laundering controls and stricter compliance measures, rather than a relaxation.

But FinCEN said it had implemented its “regulatory relief” for casinos after consultation with various industry stakeholders. This helped it realize that new technologies and third-party service providers offered “methods that can provide more reliable verification of an online customer’s identity than documentary methods.”

The original in-person and document-verification rules reflected prior technological restraints, and that the industry had since evolved,” it acknowledged.

Be Mindful

But it warned operators that third-party operators must be properly vetted and told them to be mindful that a new system could throw up new challenges.

“Allowing customers to establish their identities through non-documentary methods may be more reliable than document review in many cases,” said FinCEN. “At the same time, it opens new possibilities for fraud and other forms of suspicious activity, such as identity theft, account takeover, providing false identity information/responses.”

It also noted that some states have more stringent verification requirements, and the new federal rules do not displace state law.

Casinos have been defined as “financial institutions” under the Bank Secrecy Act since 1985. This means they are required to file Currency Transaction Reports (CTRs) on currency transactions that exceed $10,000 per day, either alone or aggregated.

They must also file a Suspicious Activity Report (SAR) when they observe behavior that could be consistent with money-laundering or other crimes. This might include a customer who exchanges a large amount of cash for chips, but gambles minimally, an immediate red flag.

Related News Articles

Most Popular

VEGAS MYTHS BUSTED: Golden Gate is the Oldest Casino in Vegas

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 6 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

No comments yet